Judul : Kakao faces prolonged slump amid leadership and AI setbacks

link : Kakao faces prolonged slump amid leadership and AI setbacks

Kakao faces prolonged slump amid leadership and AI setbacks

Kakao remains mired in crisis, with no clear path to recovery. Earnings continue to slump, and the company has failed to deliver meaningful results in the increasingly competitive race for artificial intelligence development.

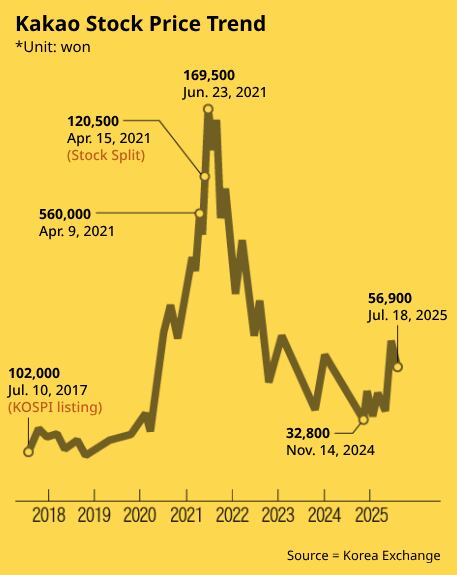

Eight years after its initial public offering on the Korea Composite Stock Price Index (KOSPI) on July 10, 2017, Kakao’s stock has recently shown signs of a rebound under the new administration. Still, shares remain at just one-third of their pandemic-era peak.

Since 2021, the company has been at the center of several controversies—including backlash over harming small businesses, prolonged service outages, a stock option controversy involving executives cashing out, and unchecked business expansion. Today, Kakao is grappling with a fourfold crisis: deteriorating performance, a collapsing stock price, a lack of new growth engines, and a lack of effective leadership.

“It’s unclear what Kakao’s answer would be if asked about its future revenue sources,” said an official in the IT industry. “There’s no visible strategy or leadership to overcome this crisis, and the company’s stagnation could drag on even longer.”

At its height, Kakao was one of the hottest stocks on South Korea’s stock market. Investor optimism over the growth potential of its businesses—including gaming, messaging, mobility, and advertising—drove the share price to a post-split high of 169,500 won in June 2021. However, on July 18 this year, the stock closed at 56,900 won, one-third of its peak. The modest recovery has largely been attributed to renewed investor sentiment following the launch of the new government, which pushed the KOSPI close to its record high from four years ago. From April 2024 to May 2025, Kakao shares remained stuck in the 30,000 to 40,000 won range. On November 14, 2024, the stock hit a low of 32,800 won. Among Kakao’s 1.66 million retail shareholders—the second-largest group after Samsung Electronics’ 5.1 million—some have even begun referring to the stock as a “betrayal” of their trust.

The share price reflects a broader market assessment that Kakao may struggle to establish a meaningful presence in the age of AI. After effectively failing to develop its own large language model (LLM), the company announced in February that it would launch an AI service called “Kakana,” built on OpenAI’s ChatGPT.

“Kakao has essentially admitted that it lacks the capability to build its own LLM,” said a representative at an AI startup. “How can the market expect meaningful growth from a company that relies on foreign AI technology?”

Kakao plans to release the full version of Kakana later this year, but many believe it will not be enough to shift the competitive landscape. When the beta version of the service launched in May, daily installations peaked at approximately 19,000, but user response quickly turned cold, and the number fell to under 100 per day within a month.

Amid its failure to articulate a long-term vision, the group’s overall earnings are also in decline. Kakao has posted three consecutive quarters of revenue loss, from the third quarter of 2024 through the first quarter of 2025. Operating profit dropped 34% year-on-year to 107 billion won ($77 million) in the fourth quarter of 2024 and declined a further 12% to 105 billion won in the first quarter of this year. A Kakao spokesperson said, “Weak performance in the content sector—including music, games, webtoons, and media—led to an overall decline in group earnings.” For the second quarter, the company is projecting another drop in both revenue (down 2.8%) and operating profit (down 5.22%).

Employee frustration has also surfaced over rising fixed costs. “We’re paying massive rent every month because Kakao never built its own headquarters. What were they thinking when the company was flush with cash?” one employee was quoted as saying.

Kakao has leased the Alphadom City building in Seongnam, Gyeonggi Province—from Mirae Asset Global Investments—under a 10-year agreement that began in 2022. The lease reportedly costs the company several tens of billions of won annually.

There is also no clear figure uniting the group’s scattered capabilities. Founder Kim Beom-soo is currently on trial over alleged stock manipulation tied to the SM Entertainment deal and is dealing with health issues that have made it difficult for him to stay involved in management. In March, he stepped down as co-chair of the Corporate Alignment (CA) Council, the company’s top decision-making body, to focus on treatment.

Internally, criticism has also mounted against Chief Executive Officer Chung Shin-a, who took the helm last year. Many within the company say she has failed to present a clear vision and has been unable to stem the decline in performance.

Demikianlah Artikel Kakao faces prolonged slump amid leadership and AI setbacks

Anda sekarang membaca artikel Kakao faces prolonged slump amid leadership and AI setbacks dengan alamat link https://www.punyakamu.com/2025/07/kakao-faces-prolonged-slump-amid.html

0 Response to "Kakao faces prolonged slump amid leadership and AI setbacks"

Post a Comment